montana sports betting tax rate

Mississippi Montana and Washington only allow bets from a mobile phone to be placed while on casino premises. Sports betting taxes are almost always levied as a percentage of the value of the adjusted.

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Since the inception of legal sports betting in 2018 the Garden State has collected 1695 million in taxes from 135 billion in sports betting revenues.

. High tax rates are hurting the pockets of sports bettors in other states too. Call us at 406 896-4300 our physical and mailing address is. Thats good for an effective tax rate of 125 which matches the states bifurcated tax rates of 85 on retail betting and 1425 on mobile betting.

The only legal option for sports betting in the state is through the lottery and the platform operated by Intralot. Steve Bullock signed HB 725 into law. The tax rate for the HB 725 bill has yet to be confirmed.

In Maryland there is a gambling winnings tax rate of 875. However a figure of between 85 and 10 is expected. In Tennessee and Wyoming sports betting is only available online Of the states that have not broadly legalized mobile betting three states allow it very narrowly.

While there are no physical sportsbooks located in any of Montanas larger casinos 180 kiosks or terminals were installed by the Lottery Commission. Sports betting in Montana was regulated in 2019 when Gov. But when using the app the maximum rises to 1000.

Colorado is considered on the lower end of the scale with gambling tax by state with most taxes remaining at the flat rate of 463. This gambling tax by state depends on the type of gambling for example the gambling winnings state taxes 10 on sportsbooks winnings. How States Tax Sports Betting Winnings.

Montana sports betting launched with retail and on-site mobile in early. Illinois sports betting totals Illinois market snapshot. As to who should govern the sports betting industry in Montana the early consensus seems to be leaning toward the states Department of Justices.

Sports betting in Montana was regulated in 2019 when Gov. In the final month of 2018 three draft requests were processed. 1 Conducting or participating in sports pools and sports tab games as defined and governed in this part is lawful except that.

Future of Betting Law. As Montana sports betting and Montana online sports betting becomes more popular in the state estimated tax revenue projections increase to 54 million the following year. How States Tax Sports Betting Winnings.

Montana Close Behind. The federal tax on that bet is 025 which results in an effective tax rate of 5 percent of GGR and even more of actual revenue. Montana sports betting bills drafted.

New retailer licenses cost 1000 annually. Tax Rates Licensing Fees and Proceed Distribution. The Montana Lottery is in charge of running sports wagers.

Date Casinos Handle Hold Sportsbook Revenue State Taxes. This does not explicitly state sports betting but it. The tax rate on sports betting revenue is 85.

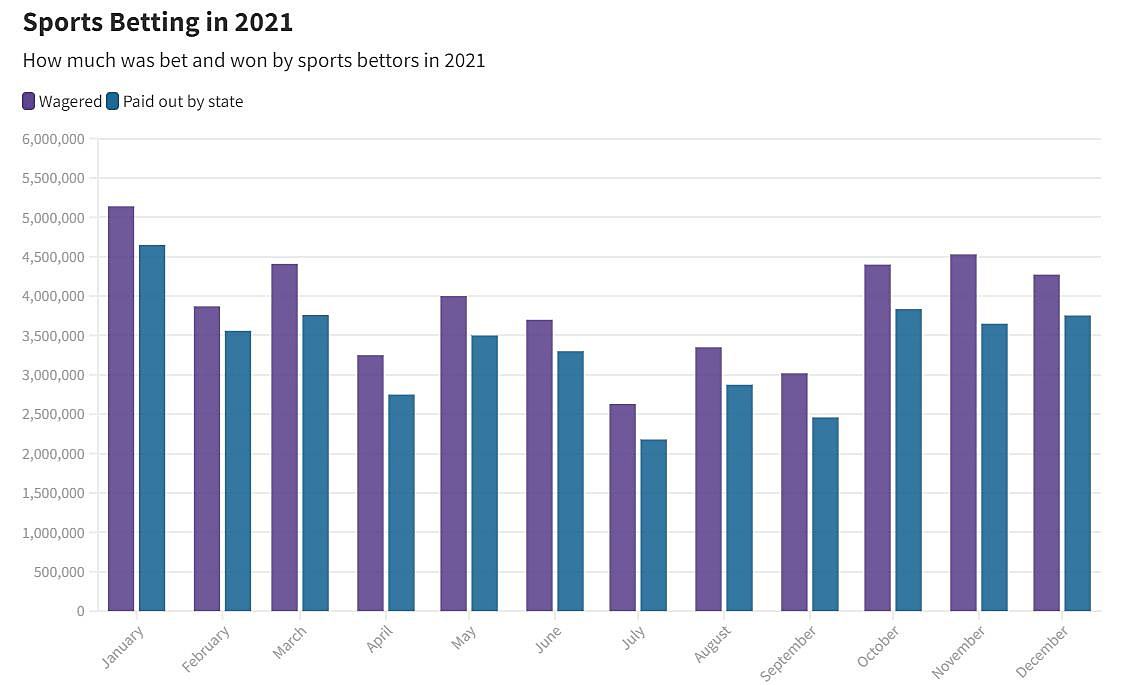

Since the legal sports betting expansion in 2018 the amount of sports betting revenue has increased dramatically. This is a very recent development as it was only signed into law on May 3rd 2019. Before paying any prize of.

An effective tax rate of 36 and a 10 million licensing fee. A sports pools and sports tab games may be conducted only by a licensed gambling operator on premises appropriately licensed to sell alcoholic. Gamblers in Montana will be able to place sports bets inside bars and restaurants with the appropriate licensing.

The Montana Lottery sports betting platform is powered by Intralot. Information on local and federal gambling laws legal MT sportsbooks sports betting sites and MT mobile betting apps. The exceptions to the rule are Delaware New Hampshire and Rhode Island which all have rates around 50 percent and Pennsylvania with a 34 percent rate.

Revenue minus management fees. How did legal sports betting in Montana become a reality. In-state betting on college sports minor league teams Online Casino.

Call us at 406 896-4300 our physical and mailing address is. Use this page to report suspicious Gambling Liquor or Tobacco related activities in Montana. Montana Gambling Control Division takes gambling crimes very seriously.

Sports Wagering Winnings Intercept. 2022 Montana sports betting. Handle Revenue Hold Taxes.

One leader Senate President Mark Blasdel believes a 10 tax rate is fair. There is a 1000 maximum bet via the app and the minimum age for betting is 18 years old. Sports pools and sports tab games authorized -- tax.

Taxes are withheld if the winnings minus the wager are more than 5000 and are at least 300 times as large as the amount of the wager. The state that reported the second-highest hold for the month of October was Montana 129 who has one of the most aggressive sports betting taxation policies in. Commonly sports betting operators have revenue known as hold of 5 percent of the handle which means that for every 100 you wager the operator takes 5 of which they must pay taxes and expenses.

The lowest rate is 2 whereas the highest is just under 6 at 575. This is in line with the national trends where the majority of states have opted for lower rates. This is based off an 85 percent tax rate on gross revenue as well as a projection of a total handle of 65 million for the first year of action.

Even though it was later to the party than the likes of New Jersey and Nevada Montanas entry to the US sports betting sector didnt take long. Intralot was awarded the contract without a public bidding process as the Greek company currently is the Montana Lotterys supplier. When looking at the states who are already allowing legal sports betting the tax rate ranges from 675 to nearly 50.

615 South 27th St Suite A. Wagers can be made through the Montana Lottery app. Retail sportsbooks in Montana.

Sports betting in Montana is now legal. States have set rules on betting including rules on taxing bets in a variety of ways. What is the tax rate for Montana sports betting.

- State taxes are currently withheld at a rate of 69 percent. Colorado has a flat-rate tax of 463 for most gamblers. 10 online 8 retail.

Sports bettors are limited to maximum bets of 250 at a kiosk or 1000 on the website. Sports betting taxes are almost always levied as a percentage of the value of the adjusted. - Federal taxes are currently withheld at a rate of 24 percent.

Bets made at sports betting terminals have a 250 maximum. In Maryland there is a gambling winnings tax rate of 875.

Montana Sports Bettors Wagered 46 Million In 2021 But Did They Win Missoula Current

Montana Sports Betting Revenue Tracker And Market Insights

Mass Senate Passes Sports Betting Bill

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Montana Sports Betting Guide To Best Mt Sportsbooks

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Montana Sports Betting Guide Is It Legal Best Mt Sportsbooks 2022

Montana Sports Betting Is Legal Sports Betting Available In Montana

Delaware Montana See Double Digit Sports Betting Holds For October

Montana Monopoly Mess Tops List Of States Screwing Up Sports Betting

Ohio Sports Betting Legislation Update Crabbe Brown James Llp

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Fact Sheet Sports Betting Georgia Budget And Policy Institute

Montana Sports Bettors Wagered 46 Million In 2021 But Did They Win Missoula Current

Sports Betting Is Now Legal In Several States Many Others Are Watching From The Sidelines

Montana Sports Betting Guide Is It Legal Best Mt Sportsbooks 2022

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings